R120 billion sale on the cards for Johann Rupert’s English giant

Johann Rupert-controlled Reinet Investments may soon sell its largest asset, Pension Insurance Corporation Group Limited (PIC), which could mark another major sale for the group.

Reinet, which the Ruperts manage as general partners, is one of three large-scale funds controlled by the Rupert patriarch, the executive chairman.

The company noted recent press speculation over the possibility of selling PIC, in which it owns an indirect 49.5% interest.

Reinet confirmed that it has been approached and is in talks relating to the potential disposal of its interest in PIC.

However, it stressed that there is no certainty that the transactions will proceed. A further announcement from Reinet will be made over the potential sale in due course if and when appropriate.

PIC, not to be confused with the Public Investment Corporation, is comfortably the largest asset Reinet owns, per its latest financial results.

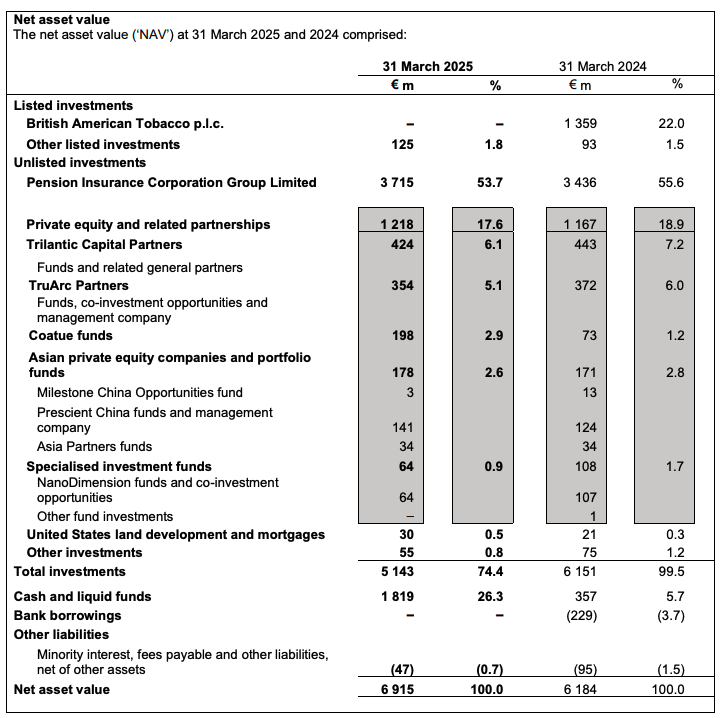

Reinet’s share is worth €3.7 billion (R77 billion), making up 53.7% of Reinet’s Net Asset Value (NAV).

The next most significant aspect of its NAV is its gigantic pile of cash worth €1.8 billion (R37 billion), which is in many currencies and placed with highly-rated banks and short-term money market funds.

Founded in 2006, the UK-based company says it focuses on investments that are secure and socially beneficial.

At the end of 2024, it had investments worth £50.9 billion (R1.2 trillion), managing the pensions of just under 400,000 policyholders.

Sky News reported that retirement services group Athora was in talks to buy PIC in a deal worth up to £5 billion (R121 billion).

PIC declared a profit after tax of £284 million (R6.9 billion), and paid pensions worth £2.2 billion (R54 billion) over the year.

Another major sale

The sale of PIC would mark another major sale from Reinet after it sold its remaining shares in British American Tobacco (BAT) last year, which is the source of its current pile of cash.

The Ruperts trace a large amount of their wealth to tobacco, with Anton Rupert, Johann’s father, establishing the Voorbrand Tobacco Company about 80 years ago.

Voorbrand would merge into Rembrandt, a major cigarette and tobacco company, in 1948. It would list on the JSE a few years later.

After the group diversified, it would break into three distinct companies: luxury goods company Richemont, South African-focused Remgro, and Reinet, which would hold the group’s stake in BAT.

The company previously held 84.3 million shares in BAT. It received over €2 billion (R40 billion) in dividends, used shares as collateral for debt and sold 36 million shares to provide liquidity.

The group held some 48.3 million BAT shares in March 2024, which were sold in late 2024 and early 2025. This resulted in proceeds of €1,627 million (R33 billion).

Despite Reinet’s investment in BAT generating an annualised return of over 11%, there are significant question marks over the latter’s future as many ditch cigarettes due to their health problems.

Following the sale of BAT, the group’s cash and liquid funds now make up 26.3% of all of Reinet’s investments, increasing from the 5.7% a year earlier.

The large amount of cash gives the company a substantial amount to invest in further companies, allowing it to further expand the Rupert empire

Rupert said that large cash will ensure the group’s ability to meet existing and future investment commitments.