Here is the expected petrol price for August

South Africa’s petrol price recoveries are holding on despite global turmoil, lining motorists up for a cut at the pumps in August. Diesel drivers, however, are in for some pain.

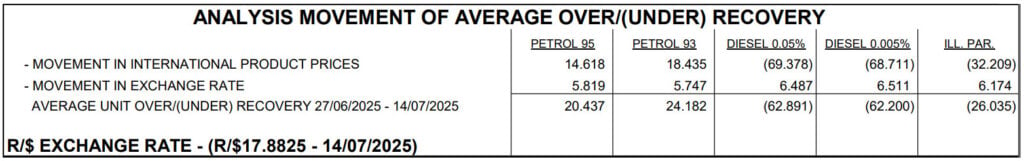

Mid-month data from the Central Energy Fund (CEF) has continued its mixed back for fuel price recoveries, with petrol in the green and diesel in the red.

Global oil prices are the main driver of the mismatch in pricing, having seen volatility and recovery in short order over the past few weeks.

The rand has remained resilient versus the US dollar, which has helped soften the blow.

The latest daily reading shows an over-recovery for petrol between 20 and 24 cents per litre. Diesel, meanwhile, is showing an under-recovery of around 62 cents per litre.

These are the projections at mid-month:

- Petrol 93: decrease of 24 cents per litre

- Petrol 95: decrease of 20 cents per litre

- Diesel 0.05% (wholesale): increase of 63 cents per litre

- Diesel 0.005% (wholesale): increase of 62 cents per litre

- Illuminating paraffin: increase of 26 cents per litre

The CEF does not present daily snapshot data for LP Gas, so it is not currently possible to give the expected price for August.

The daily snapshots from the CEF are not entirely predictive of the final fuel price adjustments, and the numbers may change by the end of the month.

The Department of Petroleum and Mineral Resources only announces the final price a few days before the implementation date.

However, the data does give a strong indication of where prices are headed, despite the uncertainty that is currently lingering in markets.

Oil prices

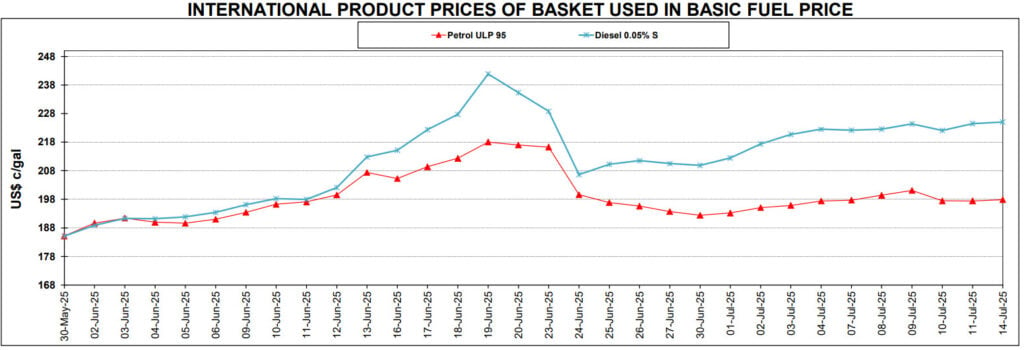

Oil markets have experienced significant swings over the past month, but they found some stability in July, though not without risk.

After shooting to over $80 a barrel in June amid escalations in the Middle East, prices recovered below $70 a barrel on the shaky truce that has been held.

However, global geopolitical conflicts are still driving the market, with prices declining this week as traders cast doubt on US President Donald Trump’s ability to pressure Russia over the war in Ukraine (and thus stymy Russian exports).

According to market analysts by Bloomberg, Trump boosted military support for Ukraine to resist Moscow’s assault, and threatened to impose 100% tariffs if the hostilities do not end with a deal in 50 days.

The planned action effectively represents secondary sanctions on countries buying oil from Russia.

India emerged as a leading taker of Russian crude as flows were reshaped following Moscow’s 2022 invasion.

China, meanwhile, has been a diplomatic and economic lifeline for Russia, and its refiners also import the nation’s oil.

However, the market has noted a distinct lack of any immediate action in relation to Russia, and believes that secondary tariff threats will not be carried out.

Overall, Brent oil has lost about 8% this year, hurt by the fallout from Trump’s trade war, as well as a drive by oil producers to relax supply curbs.

The trade balance forecast still assumes a glut in the market, hence the prices remaining under $70 a barrel.

Regardless, the impact on local fuel price recoveries is still being felt, and international product prices for diesel are diverging from petrol and slowly increasing.

As a result, diesel price recoveries are negative, building towards a sizeable hike in August. By contrast, the recovery for petrol is helping line up a cut.

Rand and dollar

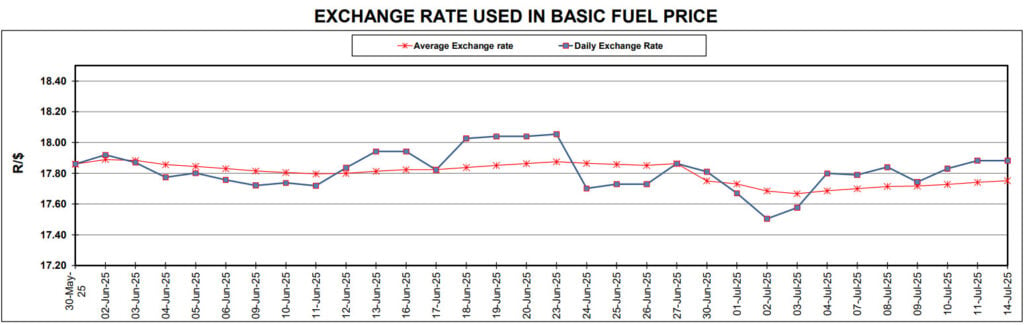

The rand has come under pressure this week as the US dollar continued to regain some of its lost strength.

Despite this, the local unit maintained a resilient position still below R18/$.

The rand has been trading stronger against the greenback in recent weeks, though this was not on account of any inhering strength or change in local fundamentals.

Rather, the rand gained on dollar weakness, driven by the Trump administration’s concerted effort to penalise countries over trade deficits by applying punitive tariffs on their exports.

According to Investec chief economist Annabel Bishop, the recent recovery in the US dollar has come amid expectations that the US will favour trade deals over the most recent spate of tariff threats.

This is evidenced through the Whitehouse’s willingness to negotiate, despite the extended 1 August deadline looming.

Negotiating better trade deals will improve the US economic growth outlook, Bishop said. A tariff war would harm it.

“Uncertainty still persists on what the final outcome will be and for how long the extensions and negotiations will continue,” she said.

“While markets are relying on the ‘taco trade’ (Trump always chickens out), there is room for disappointment.”

For South Africa, a 30% tariff is waiting on 1 August, while the US is not seen as negotiating fairly or in good faith.

As a result, there is inherent risk locally, while markets are still risk-averse, given the broader uncertainty.

Despite this, the rand is still helping build an over-recovery in local pricing for petrol, while helping to cut down the under-recovery for diesel.

This is how the price changes could be at the pumps (Diesel prices reflect wholesale, pump prices will differ):

| Inland | July Official | August Expected |

| 93 Petrol | R21.79 | R21.55 |

| 95 Petrol | R21.87 | R21.67 |

| Diesel 0.05% (wholesale) | R19.35 | R19.98 |

| Diesel 0.005% (wholesale) | R19.41 | R20.03 |

| Illuminating Paraffin | R13.15 | R13.41 |

| Coastal | July Official | August Expected |

| 93 Petrol | R21.00 | R20.76 |

| 95 Petrol | R21.04 | R20.84 |

| Diesel 0.05% (wholesale) | R18.52 | R19.15 |

| Diesel 0.005% (wholesale) | R18.65 | R19.27 |

| Illuminating Paraffin | R12.14 | R12.40 |