Most exclusive bank cards in South Africa and how much you need to earn to get one

South Africans must earn R62,500 or more per month to own one of the country’s most exclusive banking cards, one of which demands over R200,000.

One of the main attractions of possessing an elite credit card is the status that comes with it, in addition to the exclusive benefits that accompany it.

However, you will need to earn a considerable amount of money if you wish to be eligible for such a banking service.

The credit cards listed here are designed for high-income earners, including VIP customers accustomed to a wealthy lifestyle.

To afford these status symbols, customers have to be within the top 7% of income earners in South Africa, with some even requiring prospective cardholders to be firmly in the top 1%.

According to Knight Frank’s Wealth Sizing Model, in annual terms, you need to earn at least $109,000 (R1.93 million) to join the top 1% of the wealthiest South Africans.

The World Inequality Lab simulator estimates that you need R1.69 million to be in the top 1%. However, it added that the average of the group earns around R3.4 million.

In the same vein, the monthly salary you would need to be a top 1% earner is around R140,622, the data shows, which is around five times more than the average income earner in the formal sector.

Interestingly, some of the bank accounts below require clients to earn a bit more than the minimum requirement to be considered a top 1% income earner.

These types of salaries are what will put you in a position to potentially own one of these exclusive credit cards, which follow a minimalistic, sleek and black design.

Others have tried to differentiate themselves, like the noticeable and vibrant purple vertical card from Discovery Bank.

Many of these cards are offered in metal for a premium feel while also being more durable and environmentally friendly.

BusinessTech looked at some of these exclusive bank cards available in South Africa and how much you need to earn to get them. The cards and their associated requirements are listed below.

| Bank Account | Annual salary needed | Monthly salary needed |

|---|---|---|

| Discovery Purple | >R2.5 million | >R208,000 |

| Nedbank Private Wealth | >R2 million | >R166,666 |

| FNB Private Wealth | R1.8 million | R150,000 |

| Standard Bank Signature Banking | R1.104 million | R92,000 |

| Investec Private Banking | R800,000 | R66,600 |

| RMB Private Bank | R750,000 | R62,500 |

| Absa Wealth Infinite* | NIA >R10 million | NAV >R20 million |

| Average: | R1.49 million | R115 466 |

Discovery Purple not only requires the highest annual salary but also has the highest monthly fee at R684.

Considering the net worth of these individuals, an average monthly account fee of R608 will not make a significant dent in the finances of any of these wealthy customers.

| Bank Account | Monthly fee | Price change YoY |

|---|---|---|

| Discovery Purple | R684 | +R44 (6.9%) |

| Investec Private Banking | R635 | +R30 (5.0%) |

| Absa Wealth Infinite | R600 | +R25 (4.4%) |

| RMB Private Bank | R595 | +R45 (8.2%) |

| FNB Private Wealth | R595 | +R45 (8.2%) |

| Standard Bank Signature Banking | R580 | +R50 (9.4%) |

| Nedbank Private Wealth | R570 | +R40 (7.6%) |

Discovery Purple

The full banking suite is a transaction account paired with a flexible single credit facility. Clients pay one monthly fee for all their transactions.

Clients also get unlimited free savings accounts and the only Real-Time Forex Accounts available 24/7 on their banking app, at no additional monthly fees.

Clients can access Discovery’s Vitality Money programme to unlock their personalised shared-value stack of rewards.

They also get up to 75% off local and international flights, including an international business class booking.

Additionally, clients enjoy free multi-trip international travel insurance, free and unlimited airport lounge access worldwide, and faster security clearance at OR Tambo and Cape Town international airports.

Other benefits include:

- Up to 75% back on HealthyFood items at Pick n Pay or Woolworths

- Up to 50% back on HealthyCare items at Clicks or Dis-Chem

- Up to 20% back on Uber rides

- Up to 20% back on fuel purchases at BP and Shell

- Up to 40% off when the customer spends Discovery Miles

- Up to 75% off one return or two local one-way flights

- Up to 75% off an international flight with British Airways, Emirates and Qantas

- Up to 75% off fitness devices and Nike performance gear

- Up to 50% off Technogym home gym equipment rental

The account comes with your own relationship banker, access to our exclusive Discovery Purple Servicing channel and our dedicated Discovery Purple Concierge team.

Nedbank Private Wealth

- Free airport lounge access

- 24-hour concierge service for personal travel and lifestyle needs.

- Emergency assistance

- Travel and lifestyle benefits, such as discounts and special rates on accommodation, car rental and airport meet-and-assist services

- Travel insurance up to $2.5 million.

- Automatic enrolment in the Greenbacks programme, with customers earning unlimited Greenbacks at a rate of up to two Greenbacks for every R10 spent with Visa Infinite credit card or double Greenbacks with their American Express® Credit or Cheque Cards.

- Private banker.

- Team of specialists to help with wealth management needs.

- Access to the Nedbank Private Wealth App

FNB Private Wealth

This suite focuses on integrating various elements of the clients financial needs, including personalised banking, flexible lending options, investment opportunities, and insurance solutions.

FNB helps clients in making informed decisions about your finances, whether it’s daily money management or planning for the future.

The FNB Private offering includes a dedicated Private Advisor with a supportive team of specialists.

Additionally, there’s a digital platform through the FNB App that allows for streamlined financial management, along with investment solutions tailored to your long-term goals and some lifestyle benefits such as the eBucks Rewards program.

Other benefits include:

- R20,000 in annual discount savings to use on flights, car hire, bus tickets and the eBucks Shop

- Up to 40%* off selected local flights

- Up to 40%* off international selected flights

- Up to 40% off domestic car hire

- Up to 40% off bus tickets

- Up to 36 complimentary domestic and international SLOW Lounge visits a year

- Up to 24 additional SLOW Lounge visits a year when flights are booked through eBucks Travel

- Access to discounted accommodation and travel packages through the eBucks Travel desk

Clients will also have access to expert advice in areas like global investing, lending, wealth management, commercial property, and succession planning.

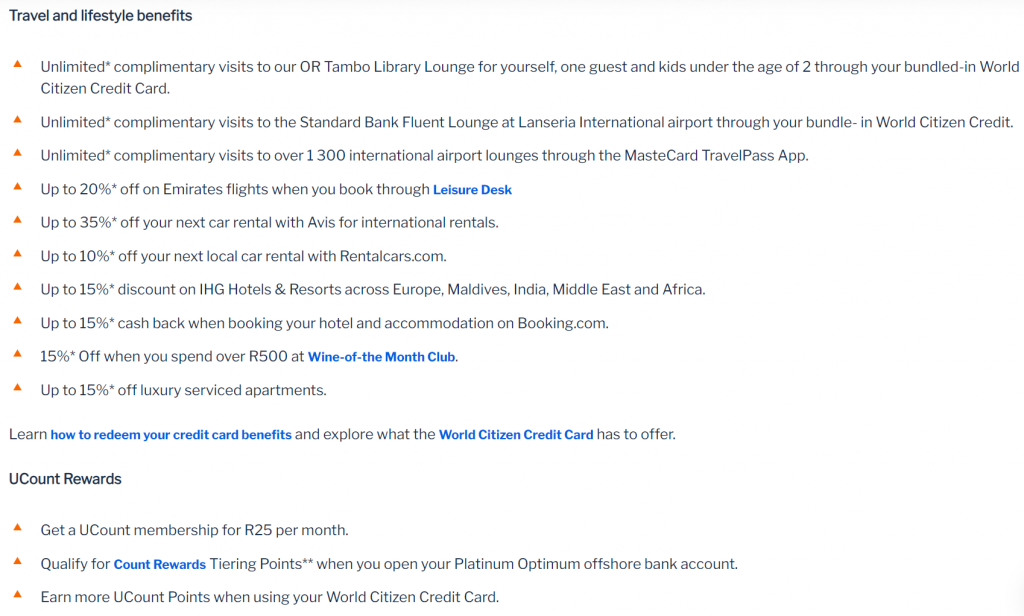

Standard Bank Signature Banking

Investec Private Banking

Investec has a rewards program for clients that includes no membership fees and allows you to earn unlimited Rewards points that don’t expire.

Clients can choose how to redeem these points based on their preferences. The program also offers access to airport lounges and other airport benefits through the InTransit app.

Additionally, Private Banking clients have access to a range of lifestyle offerings.

- A competitive debit rate of up to prime

- A Visa platinum credit card with up to 45 interest-free days on card purchases

- Unlimited free ATM withdrawals both locally and internationally*

- Interest on credit balance

- Up to 60-month budget facility option for unexpected purchases

- Complimentary local and international lounge access

- Get an extra card linked to the account at no extra cost or a stand-alone Private Bank Account at a reduced monthly fee for spouse or life partner.

- Open an Investec Youth Account, a transactional account with a Visa debit card, for no additional monthly fee.

- Open a linked Cash Management Account and earn a higher interest rate through active management of short-term surplus funds.

- Open a tax-free investment or a local unit trust for the customer and children through My Investments.

- Open a sterling-based transactional account in the UK (for an additional fee).

- Enjoy preferential exchange rates on foreign exchange whether investing internationally, making international payments or receiving funds from abroad into Investec Account.

- Get access to emergency funds with Western Union Money Transfer if card is lost or stolen while travelling abroad.

- Access to Investor Rewards

- Access to Investec Digital

- Access to Investec One Place

There’s a travel service dedicated to Investec clients, providing options for flights, accommodation, car rentals, and holiday packages, along with the flexibility to tailor a travel package to their needs.

RMB Private Bank

RMB provides a comprehensive approach to financial advice by considering all aspects of a client’s financial situation.

Their services include transactional banking, lending, investment, and insurance, with rewards designed to fit individual lifestyles.

The bank emphasises building strong personal relationships and offering specialised advisory services delivered through digital platforms. This ensures that their solutions align with both personal and professional goals.

RMB focuses on various areas such as intergenerational wealth transfer, sustainable investing, and opportunities within South Africa and globally.

They offer expertise in global investing, structured lending, wealth management, commercial property, and succession planning.

Other benefits include:

- An exclusive metal card

- Full transactional capability with a linked credit facility

- One view of transactional account

- One interest rate

- Up to 30 days’ interest-free on card purchases

- Linked additional cards

- Maximum rewards

- Account for spouses

- FNBy for kids, teens and young adults.

- Global Travel Insurance

- Access to the SLOW Lounge

- Cash@Till

- Exclusive VISA offers

Clients can expect tailored financial strategies that cater to their unique life and business aims, as well as access to various resources, including the eBucks Rewards programme.

Absa Private Banking

ABSA offers a variety of financial services through its Wealth Bankers, Investment Managers, and Fiduciary Specialists, available 24/7 via the Wealth Assist suite.

Clients receive integrated advice on banking, lending, investments, insurance, and estate planning.

Each client is paired with a dedicated team and has access to the Wealth Bundle Account, which includes preferential rates and concierge services.

Benefits also include airport lounge access and versatile investment options, featuring both onshore and offshore products.

ABSA provides stockbroking and portfolio management across 31 global exchanges, along with tailored lending solutions secured by assets.

Their fiduciary services for estate planning involve regular reviews to adapt as needed.

Insurance options cover high-value items, with personalised support and emergency assistance.

ABSA Rewards members can enjoy travel discounts and earn cash back on everyday purchases with simple redemption options.

Other benefits include:

- Exclusive black metal Wealth Infinite credit card that comes with the Absa Wealth Bundle Account, designed to meet day-to-day banking, lifestyle and travel needs:

- A single monthly fee that includes current, credit and overdraft accounts

- Most major transactional fees also form part of the monthly fee

- Automatic subscription to Absa Rewards at no additional cost and up to 30% in real cashback, depending on the Rewards tier

- Access to a dedicated Wealth Banker, Wealth Investment Manager, and Fiduciary Specialist, among other experts, to cater to client’s bespoke needs

- 50% discount on monthly service fee for Spousal account

- Up to 57 days interest-free on qualifying credit card transactions

- Unlimited access to domestic and international Bidvest Premier Lounges in South Africa, as well as unlimited international lounge access through the Visa LoungeKey benefit, which includes one free guest per visit.

- Additional features of the Absa Wealth Infinite Credit Card

- International Travel Insurance, Buyers Protection (no excess), Extended Warranty and Rental Car Collision Damage Waiver

- Access to a 24/7 Global Client Service Centre

- A concierge service for restaurant bookings, car hire, tourist activities, local services, hotels, events and concerts

- VIP rates, room upgrades and complimentary services at a curated collection of 900 hotels through the Visa Luxury Hotel Collection

- Car rental discounts through Avis of up to 35% on standard rates & 30% on international leisure rates

- Specialist airport meet-and-assist services with YQ

- Global customer assistance services

The suite also offers car rental discounts through Avis of up to 35% on standard rates & 30% on international leisure rates.