The state-owned company in South Africa that’s seen 60% growth in 2025

Telkom’s share price has surged significantly by 60% since the start of the year, with the partly state-owned company’s profits on the up.

Despite listing on the JSE in 2003, Telkom has always been tied up with the South African government, which holds a significant stake in the telco.

The South African government directly owns 40.51% of Telkom, and the Department of Communications and Digital Technologies serves as the group’s shareholder representative.

The Public Investment Corporation (PIC), which manages assets for government employees and retirees, has a further 7.45% shareholding, giving the state a combined 48% share.

Although the PIC shareholding belongs to its beneficiaries, the fund holds the proxy voting rights on those shares.

Telkom was previously majority state-owned. The PIC reduced its share in Telkom over the past year from 15.89% in March 2024, surrendering the state’s controlling stake in August that year.

While government entities may no longer control more than 50% of Telkom, the company’s official title is still Telkom SA SOC Limited, with the “SOC” standing for State-Owned Company.

The PIC’s sale also came just before Telkom announced a massive performance improvement, with the group hitting R7.5 billion in profit in 2025.

The group started paying dividends again, and even declared a special dividend following the sale of its tower business, Swiftnet, for R6.5 billion.

The group suspended dividend payments for three years in 2020 to conserve cash and buy much-needed spectrum, but it required another two years to return cash to shareholders.

In addition to group data revenue remaining strong, the implementation of several operational strategies fuelled the increase in EBITDA and cash flow growth.

Telkom’s EBITDA improved by 58.7% to R15.9 billion, while its profit for the year increased by nearly 300% to R7.5 billion.

The group’s basic earnings per share increased by 385.5% to 1,528.1 cents per share, while headline earnings per share rose 44.8% to 544.5 cents per share.

| Financials | 2024 | 2025 | % Change |

| Revenue (Rm) | 43 230 | 44 572 | +3.1% |

| EBITDA (Rm) | 10 041 | 15 939 | +58.7% |

| Profit for the year (Rm) | 1 881 | 7 503 | +298.9% |

| Basic earnings per share (cents) | 296.4 | 1,528.1 | +385.5% |

| Headline earnings per share (cents) | 376.0 | 544.5 | +44.8% |

| Dividend (cents) | – | 260.8 | >100% |

Share price booms

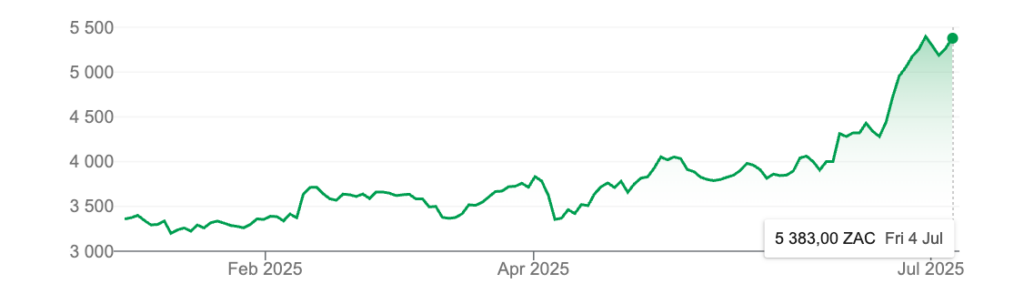

Telkom’s strong performance has seen its share price rise by 60% since the start of the year.

The group’s share price now sits at R53.83 cents per share, compared to R33.58 per share at the start of the year.

The group’s P/E Ratio also remains at around 10, which suggests that the stock is relatively cheap when looking at past earnings.

The turnaround for Telkom is expected to continue, with Sanlam Investments portfolio manager Roy Mutooni believing that Telkom has found its stride.

Speaking with BusinessDay TV, Mutooni said the telecommunications company is expected to report high free cash flow generation in the short to medium term.

Although Sanlam doubted the group’s prospects, he believes Telkom’s annual financial results suggest a company on the mend.

“Their ability to generate free cash flow was significantly greater than anybody on the market had seen before,” said Mutooni.

Telkom’s free cash flow jumped by over 500% to R2.8 billion, far ahead of Sanlam’s expectation of between R1 billion and R1.5 billion.

He noted that Telkom is starting to hit its stride and will continue to generate cash. Getting rid of Swiftnet also allows it to pay off its historical debt, with the group now having a clean balance sheet.

Telkom said maintaining a strong balance sheet remains a priority, as it will allow it to invest in profitable growth without compromising its resilience.

On top of sustaining positive free cash flow momentum, the group’s medium-term objectives include the following:

- Margin optimisation: The group wants to improve EBITDA margins for ongoing operations, ranging between 25% and 27%.

- Revenue acceleration: It wants revenue growth across all businesses to exceed inflation, currently projecting annual revenue growth in the mid-single digits.

- Strategic capital allocation: Telkom wants to maintain capital expenditure for future growth within a range of 12% to 15% of revenue.

- Balance sheet strength: The company wants to preserve a robust balance sheet with a net debt to EBITDA ratio between 0.5x and 1.5x.

“We will continue to navigate global macro-economic uncertainties and domestic challenges like high unemployment and the need for sustained economic growth to support our connectivity businesses,” it said.