Big shift for South Africa’s property market

South Africa’s property market is starting to see a shift from renting to buying, with lower interest rates set to buoy the nation’s property market.

Speaking to BusinessTech, Property24 CEO Nalen Naidoo said that following the start of the interest rate cutting cycle in September 2024, there has been a notable shift from the rental to purchase markets.

Naidoo said that stock on the platform, which gets over 7 million visitors a month, is moving quicker and receives more leads.

Although the shift has not been massive in scale, Naidoo said it does indicate that the property market is making a turn following years of the rental market performing incredibly well.

He said that further interest rate cuts would help increase sales, but this remains up in the air because of global uncertainty.

The South African Reserve Bank (SARB) has cut interest rates by a cumulative 100 basis points since September 2024 amid low inflation figures.

Although inflation expectations have reached a four-year low, economists expect the SARB to hold off on further interest rate cuts due to global uncertainty.

This is linked to the risks facing global trade, with questions over United States trade tariffs and the conflict in the Middle East.

Despite South Africa facing 15-year high interest rates in 2024, Naidoo said that the South African property market remained incredibly resilient.

The end of the year saw a turning point in the market, with sales increasing by 6% in late 2024.

He noted that the first four months of 2025 saw a slight drop in growth, with sales increasing 4% over the period.

However, this decline in growth is not systematic and was likely in response to the extended holidays in April and the closure of deeds offices in Gauteng, he noted.

A return to Gauteng

Naidoo also noted that the Western Cape overtook Gauteng for transfer values for the first time in 2024.

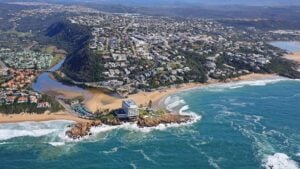

The shift of South Africans moving from other provinces to the Western Cape has been a regular feature of property reporting over the last two years, with many drawn to the improved lifestyle and better governance.

The province also remains highly popular with wealthy foreigners who can enjoy much higher living standards than in their home countries.

However, while the Western Cape took over in transfer value, Gauteng remains the province with the most transfers—expected, given its larger population.

Naidoo said that high-value properties across Cape Town often steal the limelight, but the group is noticing increased activity in areas that are well priced.

Specifically, anecdotal evidence suggests that Gauteng is becoming more affordable, with many seen ‘reverse semigrating’ back to the nation’s economic hub.

Coming back to Gauteng is becoming more common, fuelled by the return-to-office culture, work opportunities, and the lower cost of living.

A survey from CareerJunction supports this view. The group flagged a notable return to Gauteng among job seekers, with nearly 60% of the nation’s largest firms headquartered in Johannesburg.

Professionals realise that career progression and high-level networking are still centred in Johannesburg, it said.

Other property experts, such as John Herbst, CEO of Fine & Country Sub-Saharan Africa, have flagged similar trends.

“For many professionals, being close to head offices and leadership teams is essential for career growth. Johannesburg continues to be the hub for corporate decision-making,” Herbst said.