Bad news for work-from-home in South Africa

South Africa’s office rentals have surpassed pre-Covid-19 levels, highlighting that work-from-home and remote trends are reversing as workers return to the office.

The trend is seen in all of South Africa’s major metros, especially in Cape Town and Durban, which have seen massive office rental growth.

The Covid-19 pandemic forced many companies to adopt remote work. However, after the pandemic ended, many South African employees preferred working from home.

This was due to the lifestyle benefits, lower cost of travel and, for many, improved efficiencies in their work.

The trend also saw many move from major cities to new locations, as they no longer needed to be in the office.

This led to a massive decline in the need for office space, further impacting an already strained real estate sector.

However, many companies have now started to call their employees back to the office, seeking greater oversight of their workflows.

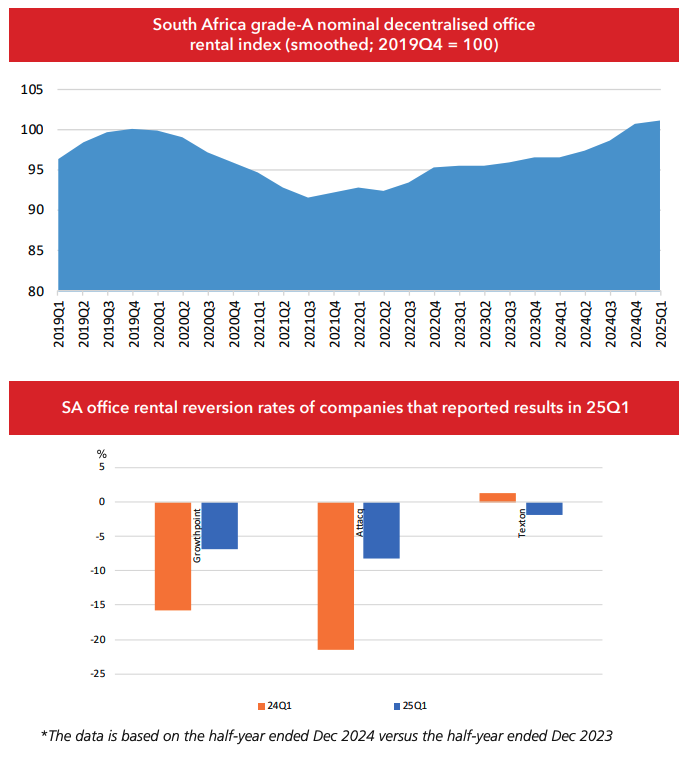

The latest Rode’s Report for Q1 2025 has confirmed this trend, with data showing that the South African office market continued to recover in the first three months of the year.

The survey results showed that vacancy rates are lower than average 2024 levels, while rentals are also up.

Weighted gross market rentals for decentralised grade-A space rose nationally by 4.8% in nominal terms in Q1 2025.

This marks an improvement over the year-on-year growth of 4.2% recorded in Q4 2024.

“Overall, rentals have recovered from the significant declines during the Covid-19 pandemic, when work-from-home trends impacted demand,” said Rode.

Q1 rentals surpassed 2019 levels by roughly 3%. That said, even with the recovery in nominal market rentals, all listed property players reported negative office rental reversion rates in Q1.

“However, the reversion decline was in single digits, with Growthpoint and Attacq showing notable improvement.”

Cape Town leads the trend

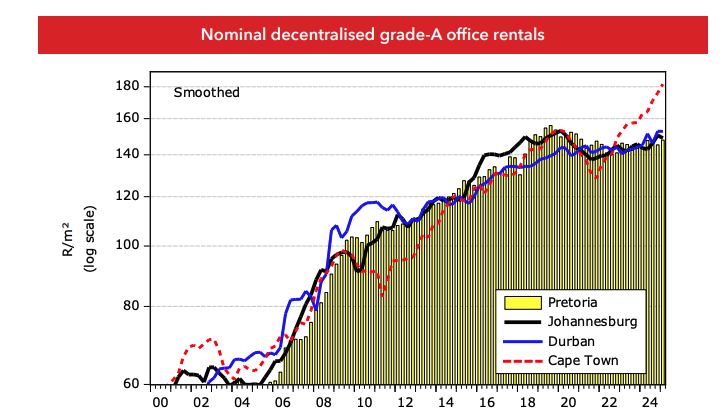

The Rode report noted that office rentals in Q1 2025 increased year-on-year in the nation’s four major cities.

Cape Town may be experiencing greater volatility, but it is also seeing high outperformance.

“Cape Town has been at the forefront of the national recovery after the pandemic, with decentralised nominal rental growth remaining in the double digits in the first quarter of 2025,” said Rode.

“Demand for offices is strong in many nodes, such as the V&A Waterfront and Claremont. The city’s perceived better governance, lifestyle and better power supply have also boosted demand.”

Its decentralised growth in market rentals for grade A space was 11.7% in Q1 2025, 22% higher than pre-COVID levels.

Looking elsewhere, nominal rental growth was strongest in Durban’s decentralised areas at roughly 5%.

The stronger rental performance in Cape Town and Durban aligns with the results of Rode’s vacancy rate data, pointing to the two cities having the lowest vacancies.

Rental growth in Johannesburg and Pretoria was the slowest among the major cities, even if they picked up to between 2% and 4%.

Rode said the Gauteng figures make sense, as both cities’ grade A vacancy rates are still over 10%.

However, it should be noted that stock of grade A+ space is limited in Sandton and Rosebank, as landlords cannot or are unwilling to subdivide.

Despite the high rental growth, not all major cities could see growth fast enough to outpace building-cost inflation, which is growing by roughly 8%, except Cape Town.