The big problem with the Reserve Bank’s new target

FNB’s economists warn that South Africa may take two years or more to benefit from a lower inflation target, and the country’s prices will have to remain benign for it to take root.

This means the South African Reserve Bank (SARB) could hit a long-term pause on interest rates, or even hike them to stabilise inflation at the lower target.

This is one of the factors that the Reserve Bank will need to consider in its path to taking the target lower.

According to the latest Q2 2025 inflation expectations report from the Bureau for Economic Research (BER), forward-looking expectations have eased, already setting South Africa in good stead for this path.

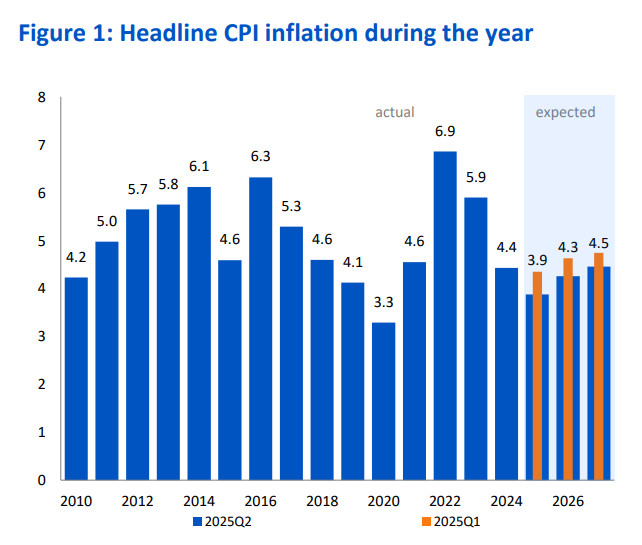

Inflation expectations from major sectors have been tempered downwards, with unions and analysts expecting the headline rate in 2025 to slow from 4.4% at the time of the previous survey to 3.9% in the latest.

However, expectations over the medium term are for average inflation to rise.

Expectations for 2026 are 4.3%, and 2027 expectations—aligning with the two-year monetary policy implementation horizon—are 4.5%. The five-year horizon expectations are 4.4%.

While the SARB anchors its inflation target at a 4.5% midpoint of the 3% to 6% target range, it wants to lower this target to around 3%. However, current expectations are out of step with this.

Inflation is currently sitting at 3%, which is well below the 4.5%. This is great news for interest rates, because it is below target and gives the SARB’s Monetary Policy Committee (MPC) room to lower them.

However, if the target is lowered, this wiggle room disappears, and South Africa may be forced to hold rates for a long time or even face potential rate hikes to bring longer-term inflation lower.

The SARB believes a lower inflation target will align South Africa with its global peers, prevent rapid price increases and result in lower interest rates in the long term.

But FNB said this longer-term outlook will require time and stability to achieve.

“A lowering of the inflation target will require inflation to remain benign in support of even slower inflation expectations,” it said.

The bank noted that when the 4.5% target was announced in 2017, it took two years for inflation trends to shift in line with this.

This was supported by lower core inflation as large-ticket items such as housing inflation experienced structural weakness. The pandemic’s inflation dip also supported the process.

However, as inflation rose again from 2021 to 2023, so did average expectations. They have again taken about two years to recover from the end-of-2022 peak.

This means that the Reserve Bank’s aim of stabilising inflation around 3% will not come quickly or easily.

Although the SARB is responsible for pursuing the inflation target, the National Treasury sets it. The two groups have discussed lowering the target, and further announcements are expected soon.

Devil in the details

Although muted current inflation levels will assist in containing average expectations, a look at the data shows different pressures.

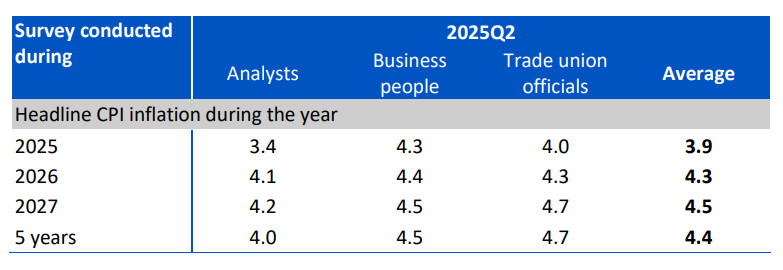

FNB noted that analyst expectations are more forward-looking and tend to have lower average inflation expectations.

Analysts expect inflation of 3.4%, 4.1%, and 4.2% over the 2025 to 2027 horizon, respectively.

However, businesses expect inflation of 4.3%, 4.4% and 4.5%, respectively, while trade unions expect 4.0%, 4.3% and 4.7%.

The five-year-ahead expectations are 4.0%, 4.5% and 4.7% for analysts, business and trade unions, respectively.

Although analysts can influence pricing behaviour, business and trade unions are the primary price setters in the survey.

“The higher expectations of these agents, bar the impact of actual economic impediments, suggest that an upside inflation bias could be upheld,” said the experts from FNB.

Households also maintain an elevated inflation outlook of 5.4% over the next year, and 8.5% for the next five years. This highlights the underlying inflationary pressures.

Although inflation is muted right now, some items in the basket remain incredibly high. Household experiences of inflation are determined by spending patterns.

Lower-income households will be more affected by food, while higher-income households are more sensitive to transport and insurance costs.

Nevertheless, higher household expectations reflect the nuances beyond headline inflation readings.

“This is a dynamic that will also affect how quickly the SARB is able to efficiently and sustainably achieve a lower inflation objective,” said FNB.

“High administered inflation may need to be compensated for by further non-admin core disinflation, which suggests less monetary policy easing.”

Nevertheless, it is noted that the efficacy gained from a credible central bank and effective communication cannot be overlooked.