Goods news for Absa and Nedbank

All Weather Capital chief investment officer Shane Watkins believes Nedbank and Absa offer good value to investors, with both banks now under new leadership.

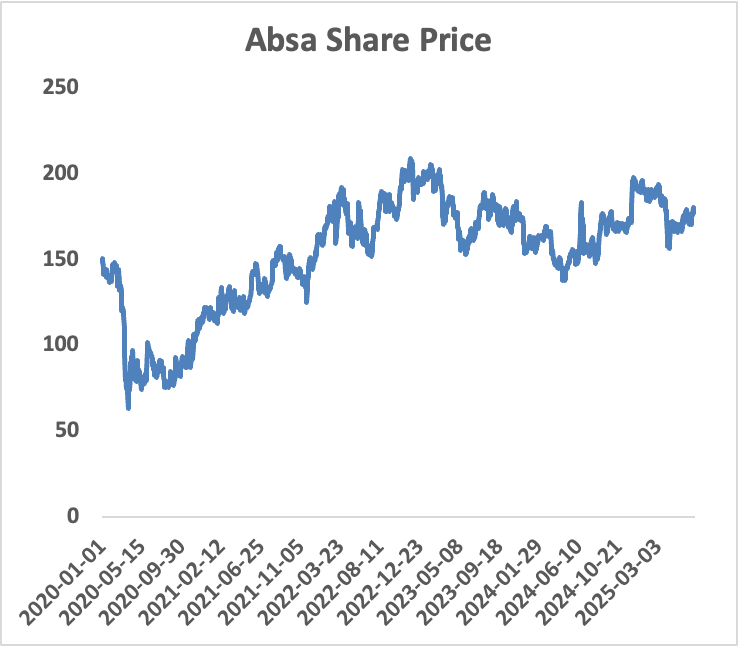

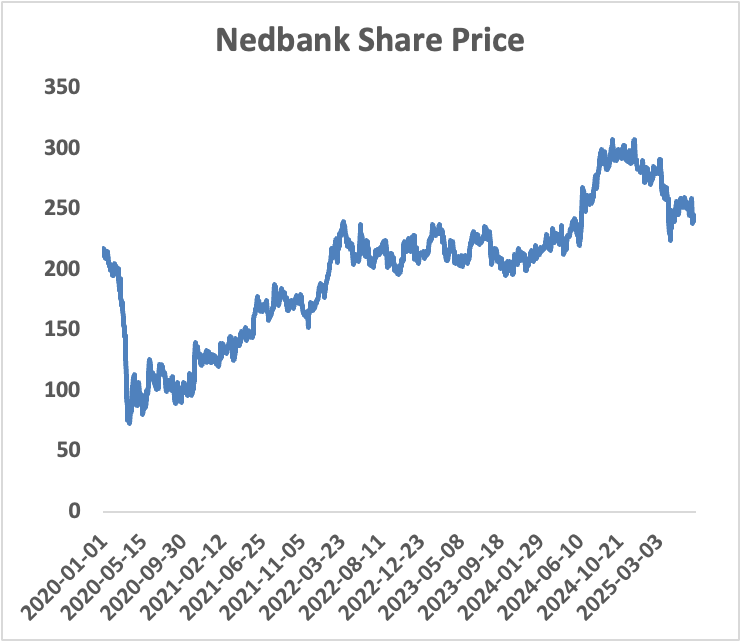

Speaking to Business Day TV, Watkins said Absa and Nedbank are currently the cheapest banks in South Africa in terms of stocks.

The banks are both trading at price-to-earnings ratios of roughly 6, while Standard Bank is at 8, FirstRand is at 10, and Capitec is at 30.

They are also trading at or just under book value. Book value essentially refers to the value shareholders would receive from liqudiating the banks.

In his experience, Watkins said that if you acquire a bank that is not distressed at less than book value, and are patient, there will be strong returns.

He said that 30 to 40 years’ worth of data shows that buying banks around book value will lead to money in the long term.

He added that both banks are now under new leadership. Former Absa FD Jason Quinn has taken over at Nedbank, and former Standard Bank Deputy CEO Kenny Fihla is Absa’s new CEO.

Watkins noted that neither of the banks is particularly well run, but both CEOs could benefit from easy wins, which should allow them to operate more efficiently.

He said that the new leadership makes both banks attractive. However, he did stress that market conditions play a major role in their fortunes.

South African banks tend to like low bond yields and a strong rand. The banks should be fine if the SA ten-year bonds do not sell much above 10% and the rand remains stronger than R18 to the dollar.

Banks are still highly influenced by the performance of fixed income and currency. If Donald Trump’s incoming tariffs take effect, there could be a large sale of assets.

Nevertheless, he believes that both banks are still strong investment opportunities.

Big changes

Both banks have seen relatively strong performances in recent times, with both seeing their headline earnings increasing by double digits in 2024.

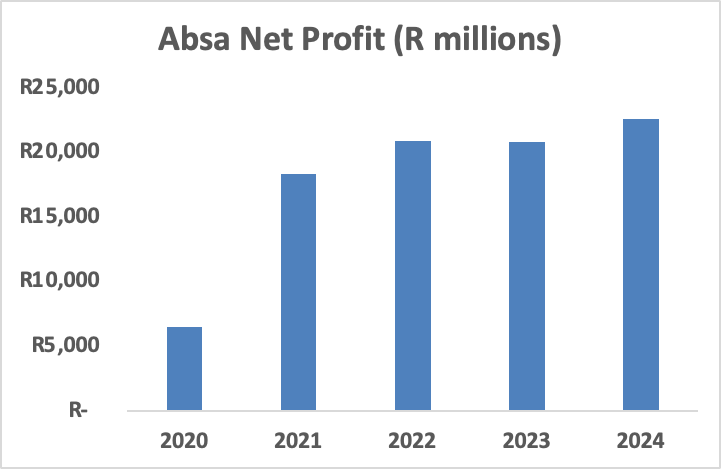

Absa’s headline earnings grew by 10% to R22 billion, buoyed by a substantial 14% improvement in South Africa to R15 billion, while the Africa Regions remained flat.

South African headline earnings increased by 14% to R15 billion, while the Africa regions remained flat at R6 billion.

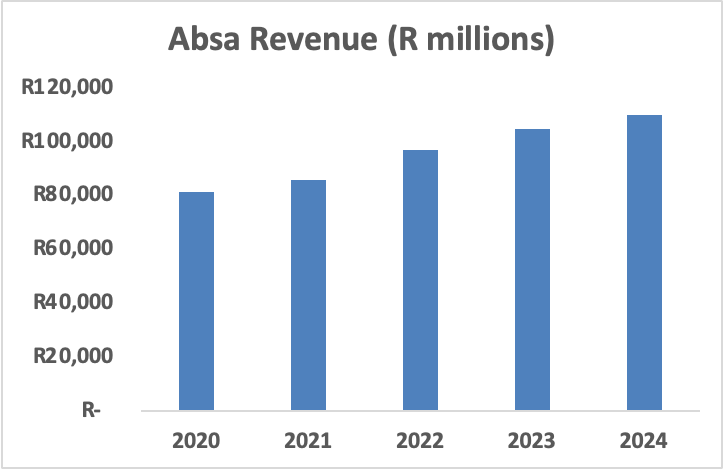

The group’s revenue for the period reached R110 billion, while its net interest income rose by 4% to R71 billion and non-interest income increased by 6% to R39 billion.

Its credit impairment charges also decreased by 8% to R14.3 billion, improving the credit loss ratio to 1.03% from 1.18%.

Having joined in June, Fihla said that a large amount of his time will be spent engaging with customers, while also trying to free branches from their prison-like look.

With a bit more time on the job, Quinn is overseeing a massive restructuring at Nedbank, which will see it split its Retail and Business Banking (RBB) and Nedbank Wealth clusters into new segments.

The new segments will include:

- Personal and Private Banking (PPB)

- Business and Commercial Banking (BCB)

- Corporate Investment Banking

The restructuring will move several business segments around, with RBB also now including Nedbank Insurance and Nedbank Wealth Management.

The bank will hope to upsell its clients and is taking a more client-centric approach to remain competitive in the banking space.

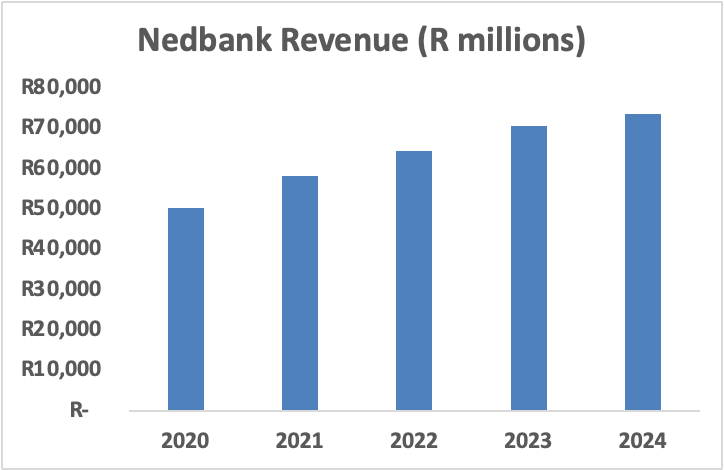

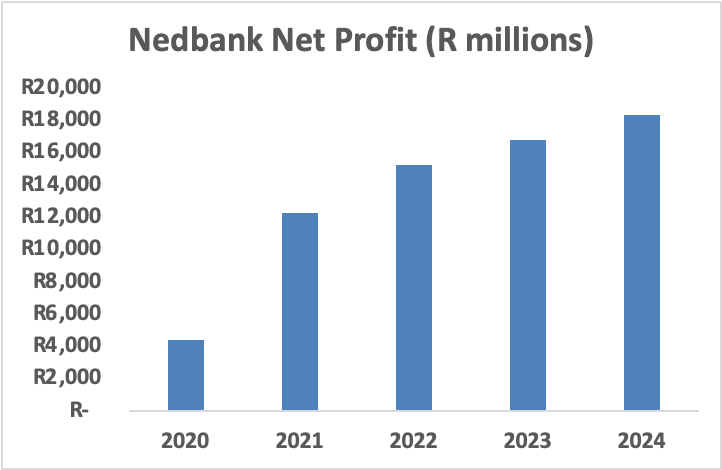

This comes after the group delivered an improved financial performance in 2024 as headline earnings increased by 8% to R16.9 billion.

Quinn noted that the good non-interest revenue, lower impairment charges and targeted expense management underpinned headline earnings growth.