The provinces in South Africa at risk of entering recession

Three provinces in South Africa are at risk of entering a technical recession following the dismal economic performance in the first quarter of the year, and hopes for a better Q2 are diminishing.

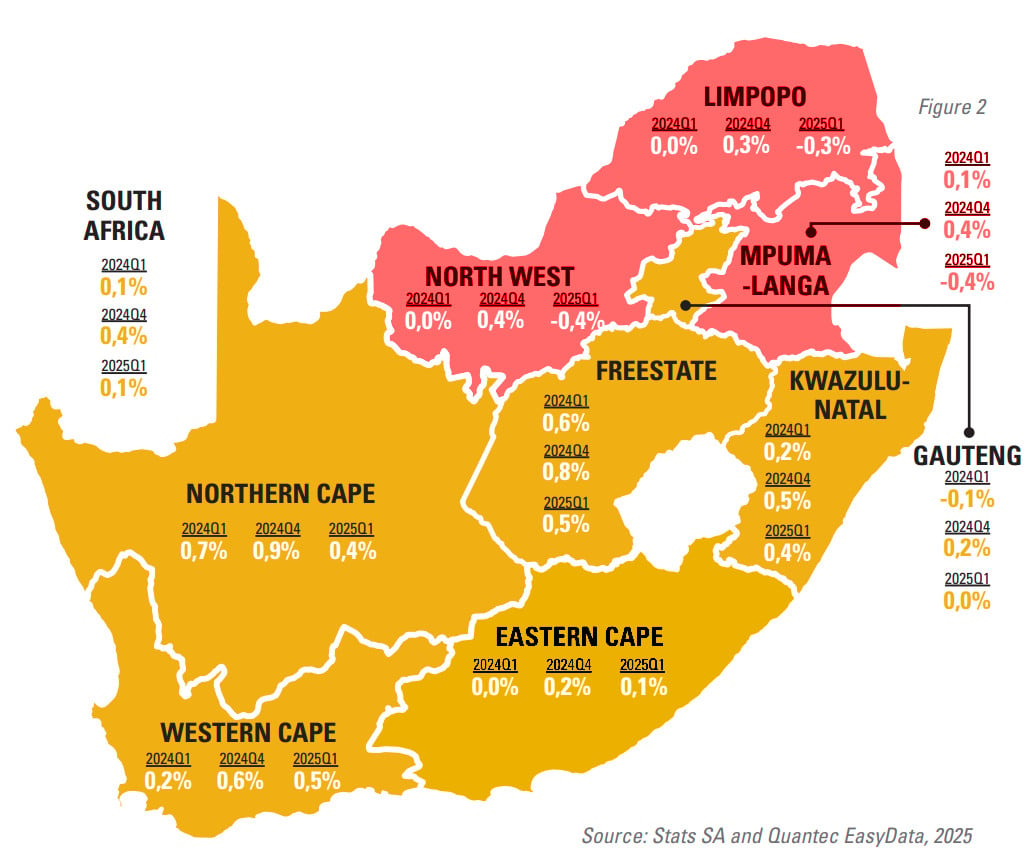

While South Africa as a whole narrowly missed contracting in the first quarter, reporting a paltry 0.1% growth, not all provinces were in the green.

According to the Eastern Cape Socio-Economic Consultative Council (ECSECC), the Free State and Western Cape provinces recorded the highest GDP growth of 0.5% in 2025Q1.

This was followed by the Northern Cape and KwaZulu Natal province with the same GDP growth rate of 0.4%. The Eastern Cape recorded GDP growth of 0.1%, and Gauteng was flat at 0.0%.

Three provinces, namely the North-West, Limpopo and Mpumalanga, all contracted in Q1.

This puts them at risk of entering a technical recession—two consecutive quarters of negative growth—when data for the second quarter hits.

South Africa has just entered into the third quarter of the year, spanning July through September, with economic data for Q2 still being processed.

However, economists and analysts have already started raising red flags over the second quarter’s GDP performance, with leading indicators pointing to yet another strained period for the country.

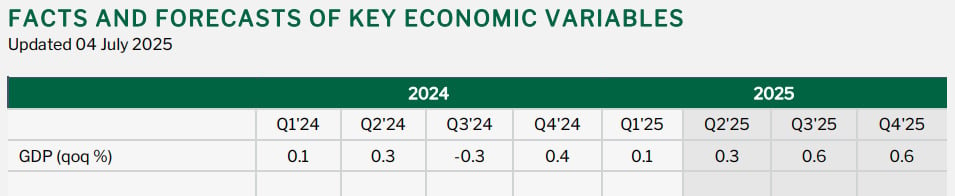

According to Nedbank’s quarterly forecasts, the second quarter of the year is expected to yield a similar outcome to the first, with GDP growth barely scraping by with 0.3%.

This is reflective of the various local and global issues that impacted local trade and the business environment at large over the period.

Specifically, April, May and June 2025 saw US President Donald Trump launch his global trade war, while conflicts in the Middle East between Israel and Iran escalated, impacting oil prices and the global economy.

Locally, infighting between the leading parties of the Government of National Unity (GNU) broke out over the 2025 budget, leaving ructions between political parties that have not dissipated, only intensified.

This has put significant strain on efforts for reform, particularly in the key sectors needed to spur economic growth.

While the second phase of Operation Vulindlela was launched in May, the first phase remains largely unresolved, with doubts as to whether the GNU can hold it together to get anything done.

Second quarter at risk

Nedbank said that the visible tensions in the government were one of several key factors hampering South Africa’s growth in the first half of the year, including the second quarter.

Persistent and intensifying weakness in mining and manufacturing, on top of failing municipal services, regular disruptions to water supply, and significant flood damage in several provinces are others.

Additional external factors at play, including South Africa’s strained diplomatic relations with the US and the uncertain future of AGOA, are likely to keep Q2 GDP data under pressure.

While the group initially held a more optimistic view for Q3 and Q4, the announcement of a 30% trade tariff on South African exports by the United States could upend this and lead to more pain in the second half of the year.

Most economic forecasts place South Africa’s full-year growth at around 1%, with the latter quarters of the year doing most of the heavy lifting.

Nedbank forecasts 0.3% growth in Q2, followed by 0.6% in Q3 and Q4.

Deloitte economic advisor Hannah Marais said that “structural faultlines” in South Africa continue to hammer its growth prospects, and that changes require “bold reform”, which has been lacking.

“South Africa remains stuck in a slow-growth rut, held back by global uncertainty and long-standing domestic constraints,” she said.

While the government has offered many plans and promises of reforms to shift the dial and realise the 3%-plus growth needed to create jobs and change South Africa’s trajectory, implementation remains out of reach.

“Perhaps the most critical constraint is no longer diagnosis; it is implementation,” she said.

“South Africa has long been adept at coming up with promising plans for reforms, but inconsistent execution continues to hamper progress.”

“Even as reform-based initiatives continue to tick along incrementally, there is growing urgency for South Africa to forge internal unity to strengthen external engagement and sustain and build much faster momentum on overcoming domestic challenges.”