Reserve Bank governor Lesetja Kganyago gets R10 million payday

South African Reserve Bank (SARB) governor Lesetja Kganyago has received a R10 million pay package, far less than the pay packages of CEOs of the nation’s largest banks.

This comes despite the fact that the SARB acts as banker for commercial banks, while also regulating the nation’s banking sector.

The Constitution mandates the SARB to maintain price stability in the interest of balance and sustainable economic growth.

It is also tasked with protecting and enhancing financial stability, issuing and destroying banknotes and coins, and is the national payment system (NPS) custodian.

With its primary goal being stable and low inflation, the SARB was able to help keep inflation far below the 4.5% mid-point target, reaching 2.8% by May 2025.

“The main concern with South African inflation is not our ability to hit the target. Rather, it is that our target is high compared to other countries,” said Kganyago in the bank’s latest annual report.

“For this reason, despite our success in stabilising inflation, the price level is almost 20% higher than it was in 2021.”

The Reserve Bank and National Treasury, who ultimately sets the target, are working to lower the target to prevent rapid price increases.

Kganyago noted that 2024 was an extraordinary year, with 64 countries, including South Africa, holding elections.

Although the 2024 election pushed South Africa into a new era of coalition politics, it also brought with it new uncertainties.

“The world is changing. Sadly, it appears to be moving towards a more fragmented and less growth-friendly state compared to what we have experienced over the past three decades or so,” said Kganyago.

“South Africa has had it easy during this time, the environment was favourable to our country and economy, supporting demand for our exports, advancing our productivity through technology and facilitating investment through capital flows.”

A less open, prosperous and tolerant world order will bring new challenges to South Africa’s society.

With predictability becoming an ever-scarcer resource, the governor said that the SARB’s role of providing stability is more crucial than ever.

Despite the volatility, the central bank’s balance sheet has strengthened over the last year. Its foreign exchange reserves have grown further, measured in both rand and US dollar terms.

This has been driven primarily by rising gold prices. Its equity position has also improved, reflecting transfers it received following balance sheet reforms last year.

The overall group declared a R120.2 million profit over the year, sending surplus payments to the South African government.

Far less than his peers

Despite the importance of the SARB, and its independence from state control, Kganyago received far less than other banking CEOs for the most recent financial year.

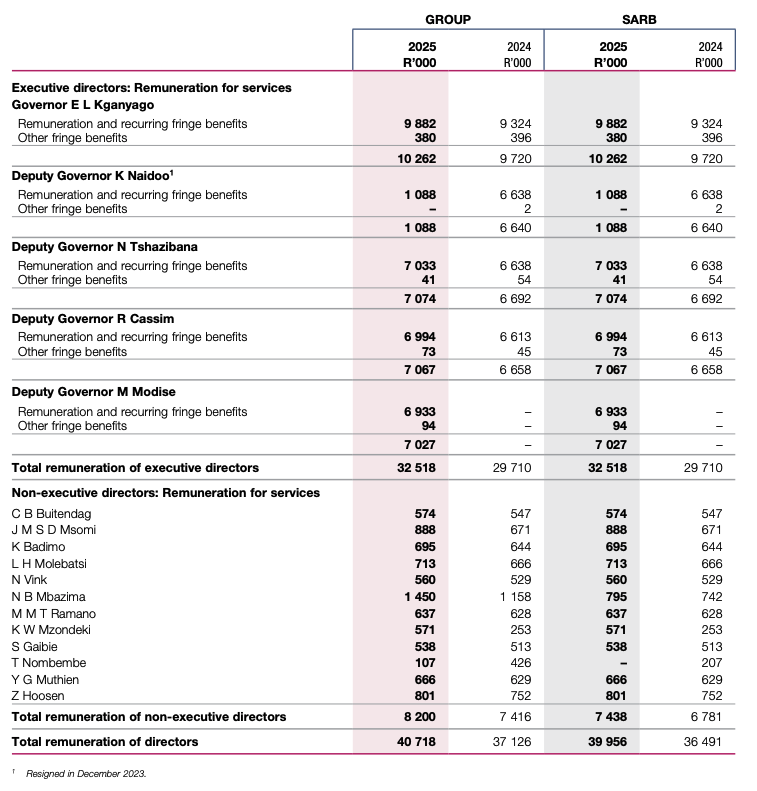

Kganyago received R10.2 million in remuneration over the financial year, while Deputy Governors Rashid Cassim, Fundi Tshazibana and recently appointed Mampho Modise all earned over R7 million.

This is far less than the salaries of prominent banking CEOs in South Africa, where pay ranges from R28 million to R105 million over the bank’s financial years.

The top of the list was Capitec CEO Gerrie Fourie, who earned R105 million over the period. Standard Bank’s Sim Tshabalala was second at R89 million, while Investec’s Fani Titi followed, earning R82 million.

The bottom of the CEO list was Nedbank CEO Jason Quinn, who earned R28 million in 2024 after only taking over the role in May 2024.

| CEO | Bank | Latest Pay |

|---|---|---|

| Gerrie Fourie | Capitec (outgoing) | R105 million |

| Sim Tshabalala | Standard Bank | R89 million |

| Fani Titi | Investec | R82 million |

| Alan Pullinger | FirstRand (former)* | R60 million |

| Jacques Celliers | FNB (former)* | R49 million |

| Harry Kellan | FNB (current)* | R42 million |

| Mary Vilakazi | FirstRand (current)* | R41 million |

| Mike Brown | Nedbank (former) | R37 million |

| Charles Russon | ABSA (interim) | R30 million |

| Jason Quinn | Nedbank (current) | R28 million |

| Lesetja Kganyago | Reserve Bank | R10 million |