A sign the tide is turning for South Africa

Despite the nation’s uncertain economic outlook, South Africa’s economy is showing signs of promise.

The BankservAfrica Economic Transactions Index (BETI), which measures the value of all transactions cleared via BankservAfrica monthly at seasonally adjusted real prices, improved in June.

This was the second consecutive month of improvement, indicating a more optimistic outlook for the South African economy in Q2 2025.

“The BETI increased in June to an index level of 139.1, representing a 0.4% monthly growth and a second month of recovery,” said Shergeran Naidoo, BankservAfrica’s Head of Stakeholder Engagements.

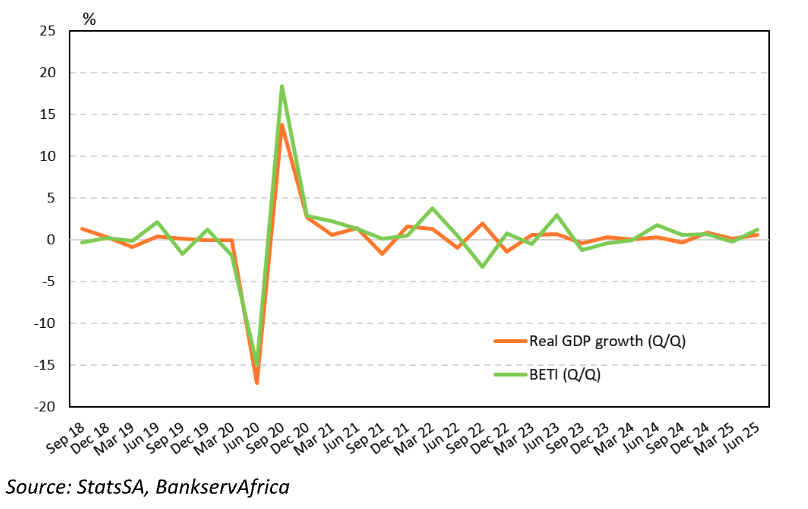

After a volatile set of months, the improved BETI signals a positive shift in overall economic activity in Q2. This may be reflected in a favourable GDP outcome published by Stats SA in early September.

“The uptick in the BETI in June is welcomed, especially given that the economy started 2025 on the back foot,” said Elize Kruger, an independent economist.

“While several sectors entered a technical recession in Q1, recent indicators suggest a rebound in mining and manufacturing, with both sectors likely returning to growth in Q2.”

Real GDP growth for Q2 is forecast at 0.6% q/q seasonally adjusted compared to 0.1% in Q1. The upward trend is in line with the BETI indications for Q2.

“While some sectors have remained resilient, others are still struggling amid ongoing challenges and notable risks,” said Kruger.

“The renewed uncertainty about the impact of US import tariffs does not bode well for confidence and investments, and will increase the downside risk to growth forecasts in 2025 and beyond.”

South African exports are expected to come under pressure from higher tariffs. However, the elevated gold price and lower international oil prices could also soften some of the impact.

In addition, a considerable share of the South African export commodities has also been exempted from the announced US import tariffs, providing a potential buffer.

Other good signs

The BETI’s continued recovery is also reflected in other timely economic indicators, such as the latest Naamsa data, which revealed that the total vehicle sales improved by 18.7% y/y in June 2024.

Year-to-date sales are also up by 13.6% compared to a year earlier, while new car sales in June grew by a massive 21.7% year-on-year.

The S&P Global South African Purchasing Managers’ Index (PMI) remained in expansionary territory with an index level of 50.1, though down from 50.8 in May.

While the report noted ‘mixed signals’ from the underlying components, the average quarterly reading was higher than in Q1.

On the other hand, the seasonally adjusted Absa PMI, which looks at the manufacturing sector, remained in contractionary territory for an eighth consecutive month at 48.5 index points, but up from 43.1 index points in May.

Some structural tailwinds should also buffer the economy against global problems. Headline inflation is below the South African Reserve Bank (SARB) 3-6% target band at 2.8% in May.

The average 2025 forecast is expected to be around 3.5%. The favourable inflation environment has allowed the SARB to cut interest rates.

“Carpe Diem Research Services forecasts a 25bps cut to be announced at the upcoming Monetary Policy Committee meeting on 31 July, likely the final cut in the current downward cycle,” said Kruger.

She added that the low inflation environment will help recover salary earners’ purchasing power.

“With average salary increases expected to be between 5% and 6%, 2025 will be the second consecutive year of real increases in salaries.”