Big win for Johann Rupert’s golden child

Richemont quarterly sales rose as the Cartier owner proved resilient amid a wider demand downturn for luxury goods.

Chiarman Johann Rupert controls Richemont despite holding only 10% of its economic interest. This is due to the family’s ownership of 51% of the company’s voting rights via its B shares.

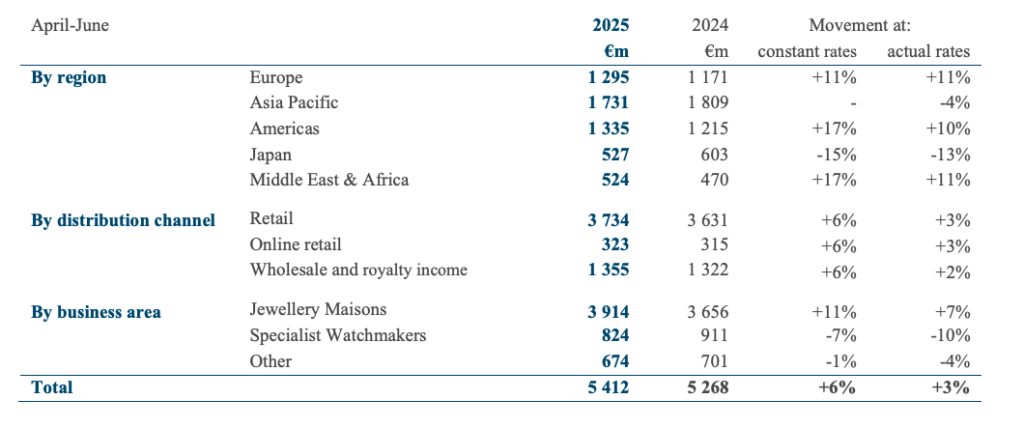

Sales at the jewelry division, its largest, surged 11% at constant exchange rates in the quarter ending in June, Richemont said in a statement Wednesday. Analysts had expected a gain of 8.6%.

Richemont has withstood the weakening in demand for luxury goods better than most peers thanks to its jewelery brands Cartier and Van Cleef & Arpels.

In times of economic uncertainty, high-end jewelry is often viewed as an investment with more intrinsic value than pricey apparel and leather goods.

Overall, the luxury industry is struggling with a slowdown caused in part by Chinese shoppers reining in costly purchases amid high youth unemployment and a property crisis.

US President Donald Trump’s tariff threats have also weighed on consumer confidence in the US and elsewhere.

Shares of Richemont have gained 10% so far this year, while those of rival LVMH Moët Hennessy Louis Vuitton SE, which is exposed to the more volatile ready-to-wear and handbag categories, are down around 25%.