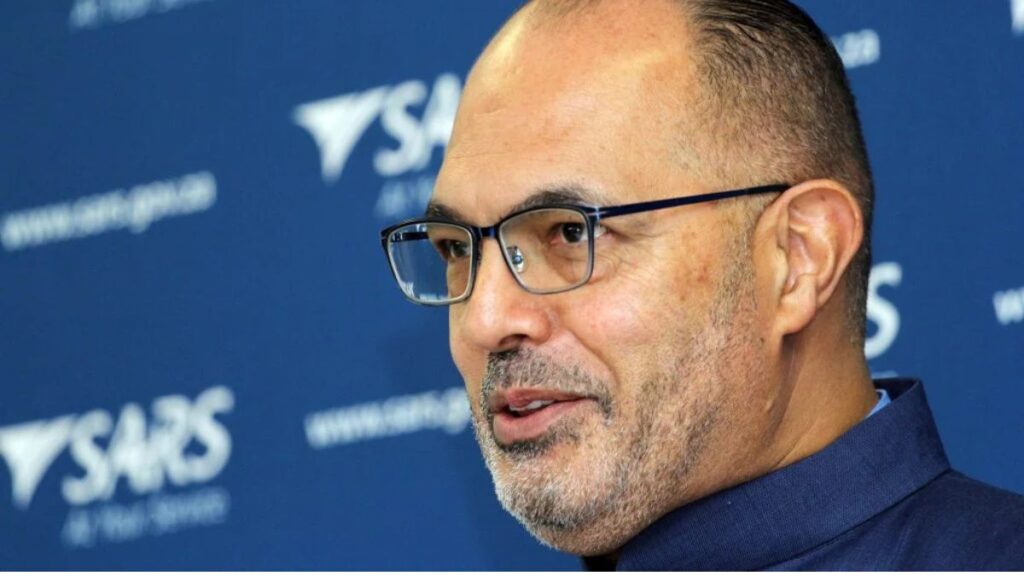

Edward Kieswetter’s warning to all South African taxpayers

South African taxpayers have been warned about a rise in sophisticated scams as the 2025 tax season kicks off.

This is according to the South African Revenue Service (SARS) Commissioner Edward Kieswetter, who outlined the popular scams making the rounds and the dates for the 2025/26 tax season.

“There’s been an increase in notices that seek to obtain access to your profile and ask for information that SARS would not ask for,” said Kieswetter.

He warned that these scams include fake audit notices and phishing links sent via SMS, targeting taxpayers who are expecting refunds. Kieswetter stressed that taxpayers should be extremely cautious.

“SARS will never ever ask for personal details. We really caution taxpayers not to press through on links that appear via text messages because these will not be coming from SARS.”

He explained that scammers exploit this period when many are expecting refunds, sending false messages that trick individuals into disclosing sensitive information. The Commissioner also highlighted the risks of password sharing.

“We find that almost always password breaches or so-called profile hacking is when taxpayers inadvertently or unwittingly share their password with friends, family or even practitioners,” he said.

In response, SARS has introduced two-factor authentication and may ask for additional confirmation, like a one-time PIN, for high-risk transactions.

Kieswetter urged taxpayers to verify all communications using SARS’ official channels. “If you’re not sure about a message, then don’t respond to that message,” he advised.

For those with smartphones, the Commissioner recommended using the SARS website, the mobile app, or the online query system.

“We also have an AI assistant or chatbot that taxpayers can use to engage with SARS,” he added.

“We’ve really taken significant precautions for taxpayers to minimise their risk of being defrauded by unscrupulous operators who have no other interest but to enrich themselves illegally.”

Contact your bank immediately

Kieswetter added that if someone has already fallen victim to a scam, there’s little SARS can do after the fact.

“Unfortunately, we can’t assist once taxpayers have breached their own confidentiality or allowed someone access to change their bank details,” he said.

However, Kieswetter encouraged victims to report fraudulent activity to their banks, which may have phishing detection tools in place. He noted that scammers often impersonate SARS, law enforcement, and even banks.

“For most taxpayers, filing season is refund season. Taxpayers who expect a refund tend to file earlier, and those who think they may have to pay in usually wait until the last moment,” he said.

Auto-assessments began on 7 July and will run until 20 July. “Between the 7th and 18th, selected taxpayers will receive an SMS from us informing them that their assessment is ready,” he said.

“If they’re happy with the outcome, they need do nothing. We’ve done all the work for them.” SARS aims to pay refunds within 72 hours if there are no complications.

For non-provisional taxpayers not selected for auto-assessment, the filing period runs from 21 July to 20 October.

“They will receive an assessment outcome in under five seconds. If selected for verification, SARS aims to finalise the matter within 21 days and pay out any refund,” said Kieswetter.

Provisional taxpayers will file from 21 July to 19 January, and trusts from 19 September to 19 January.

While SARS has improved turnaround times, Kieswetter warned that tough economic conditions will make revenue collection a challenge this year.

“We’ve revised our economic growth forecast downward. Many companies are underperforming, and South Africans are financially strained,” he said.

He added the two-pot retirement system has put nearly R50 billion back in the hands of taxpayers, with R15 billion collected in taxes.