Huge relief for petrol prices in South Africa

Despite some volatility in global oil markets, a resilient rand is keeping petrol price recoveries in check, supporting potential cuts in August.

The latest data from the Central Energy Fund (CEF) shows that petrol prices continue to show an over-recovery despite uncertainty in the market.

Notably, global oil markets have steadily been growing following President Donald Trump’s announcement that he would pursue higher tariffs on various countries, including South Africa.

The rand, meanwhile, has remained relatively stable amid the uncertainty, helping recoveries stay in check.

Trump announced that the pause on his “Liberation Day” tariffs would end this month, extending the start date for the tariff regime to 1 August.

The tariff will be set at 30% for South Africa, but the three-week implementation delay allows for more negotiation.

Because of this, markets were not as rattled as in previous cases where the outcome of Trump’s erratic policy shifts was unpredictable and uncertain.

However, oil markets were not spared by the announcement, gaining from around $66 a barrel to just under $70 a barrel.

Investors continue to monitor US trade policy, its impact on demand, and possible retaliatory measures from the targeted countries.

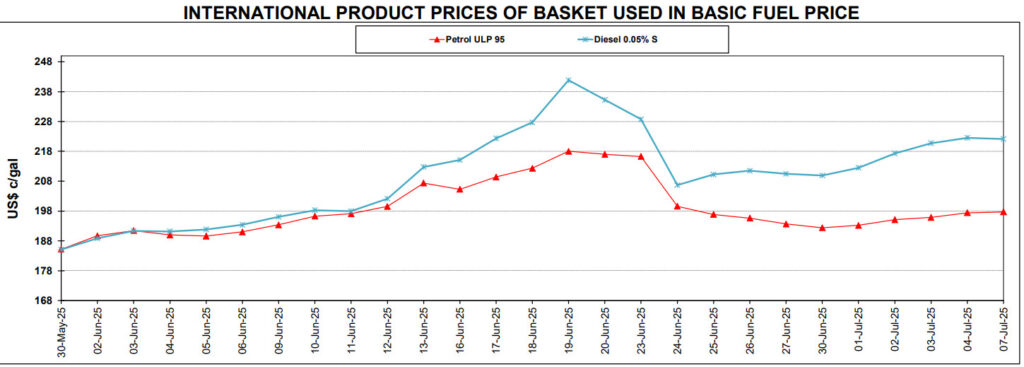

However, prices still remain lower this year, having eased from the volatility that was kicked up in June because of the war between Israel and Iran.

With a fragile truce in place for now and the focus back on global trade and supply from oil producers (OPEC+), the scales are tilting back towards an oversupply in the market.

This has kept global oil prices lower, helping with an over-recovery for petrol in South Africa.

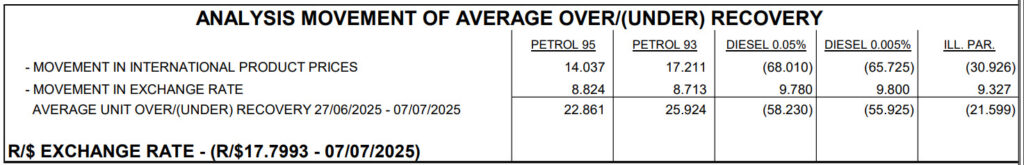

For petrol prices, it is contributing to an over-recovery of around 16 cents per litre. For diesel, however, the picture is still negative, with global product prices giving an under-recovery of about 65 cents per litre.

The global product prices for diesel are often higher than those for petrol due to higher refining costs, processes, and additives.

The volatility in the markets in June caused a much higher spike in these costs, which have not subsided, hence the split in pricing trends between diesel and petrol.

Petrol and diesel price expectations for August

- Petrol 93: decrease of 26 cents per litre

- Petrol 95: decrease of 23 cents per litre

- Diesel 0.05% (wholesale): increase of 58 cents per litre

- Diesel 0.005% (wholesale): increase of 56 cents per litre

- Illuminating paraffin: increase of 22 cents per litre

Resilient rand is helping

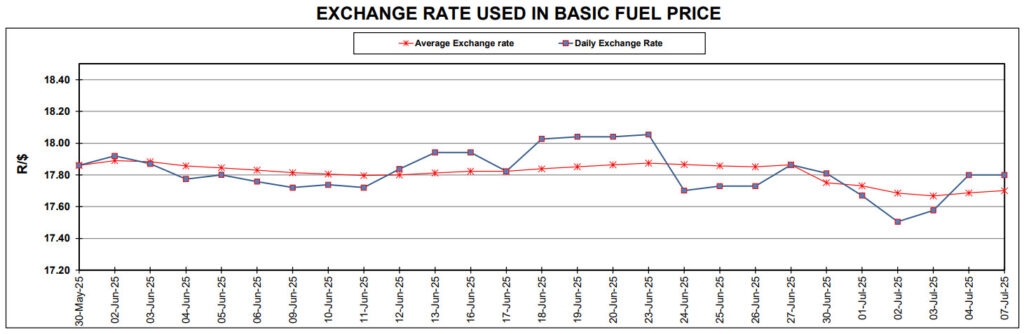

The over-recovery for petrol has been supported by a positive boost from the rand, which has weathered the storms of the past few weeks, even mostly shaking off the Trump tariff announcement.

According to Investec chief economist Annabel Bishop, the rand’s resilience is more due to dollar weakness than any inherent strength.

She noted that the rand was nearing a key resistance level of R17.50/$ last week. However, due to the uncertainty caused by Trump’s tariffs, the dollar has rebounded, weakening the rand.

“The ongoing uncertainties around global trade, with high levels of protectionism, including tariffs, negatively impact globalisation and global growth,” Bishop said.

“This has caused some market concerns, seeing US dollar strength on some safe-haven purchases. The rand has weakened against the major currency crosses as well, as global risk is seen to have escalated.”

The local unit is now trading around R17.77/$, but this is still stronger than the weaker levels over R19/$ seen earlier in the year, the last time the tariff war was in focus.

Importantly, the rand is stronger relative to its performance in June, which is supporting an over-recovery in local fuel pricing.

The rand’s resilience is currently contributing around 10 cents per litre to an over-recovery, but any further weakness could diminish this benefit.

Bishop noted that the US frequently changes the goal posts of its trade policy, making the period ahead likely volatile.

She expects that South Africa will continue to engage with Washington in the remaining three weeks of July to attempt to bring the 30% tariff down and spare the country from the worst.

“Under the 30% tariff regime, South Africa’s vehicle exports are particularly impacted, along with those of agriculture and 25% tariffs on iron and aluminium,” she said.

“In addition, uneven tariff impositions among countries mean demand for South African goods could weaken.”

In this scenario, along with the expected loss of AGOA, the rand could weaken further and push toward R18.00/$ or over in Q3.

“The rest of this month, and early August, is expected to be a fairly volatile period, as markets hang on trade and other policy commentary from the US,” she said.